The U.S. vs China trade war is in full swing, every market is hanging on for life right now.

But the show is not over yet.

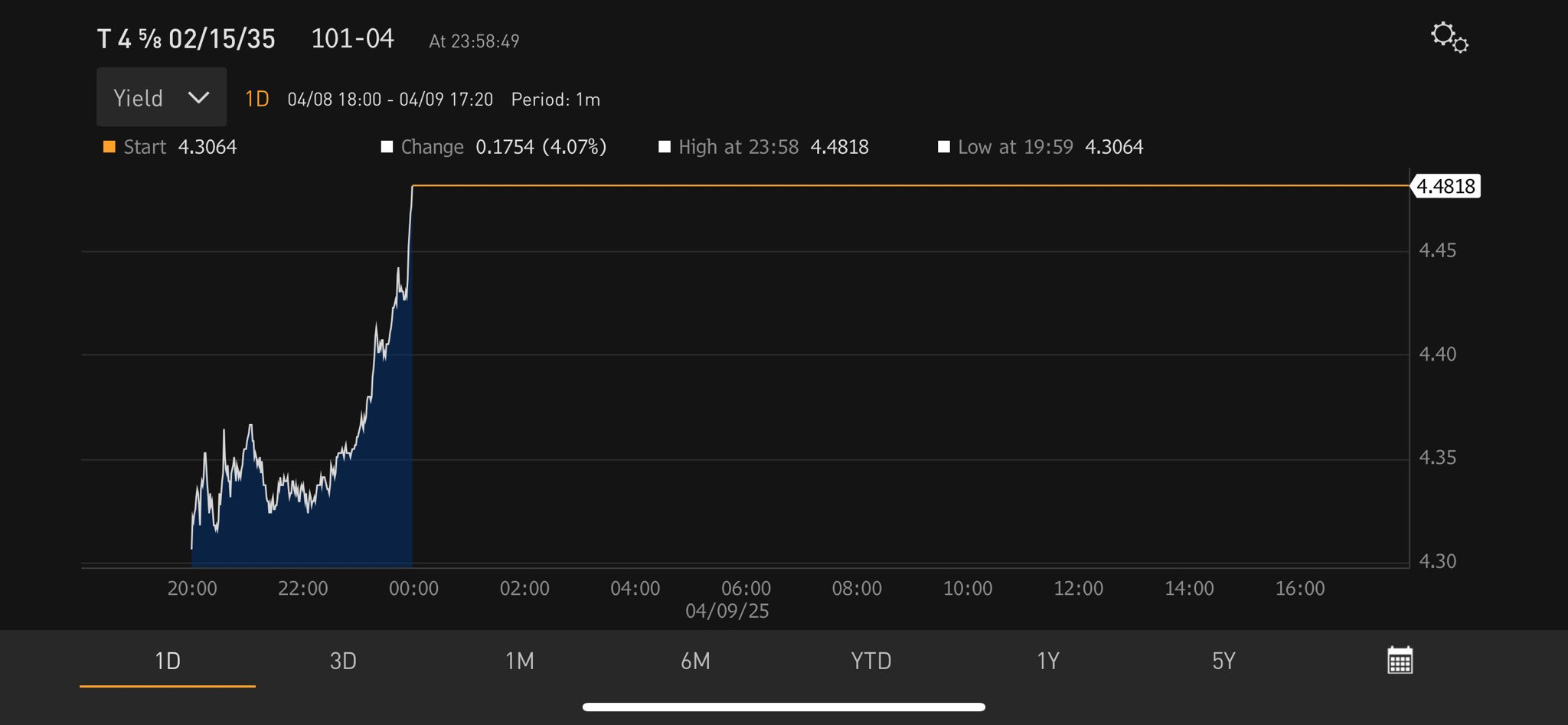

We all know Trumps intention was to bring down the U.S. treasury yield so they could refinance the exploding debt at lower rates.

Now there's been a MAJOR shake up, something has broken in the system.

The 10 year yield has spiked to 4.5%, going completely against the plans.

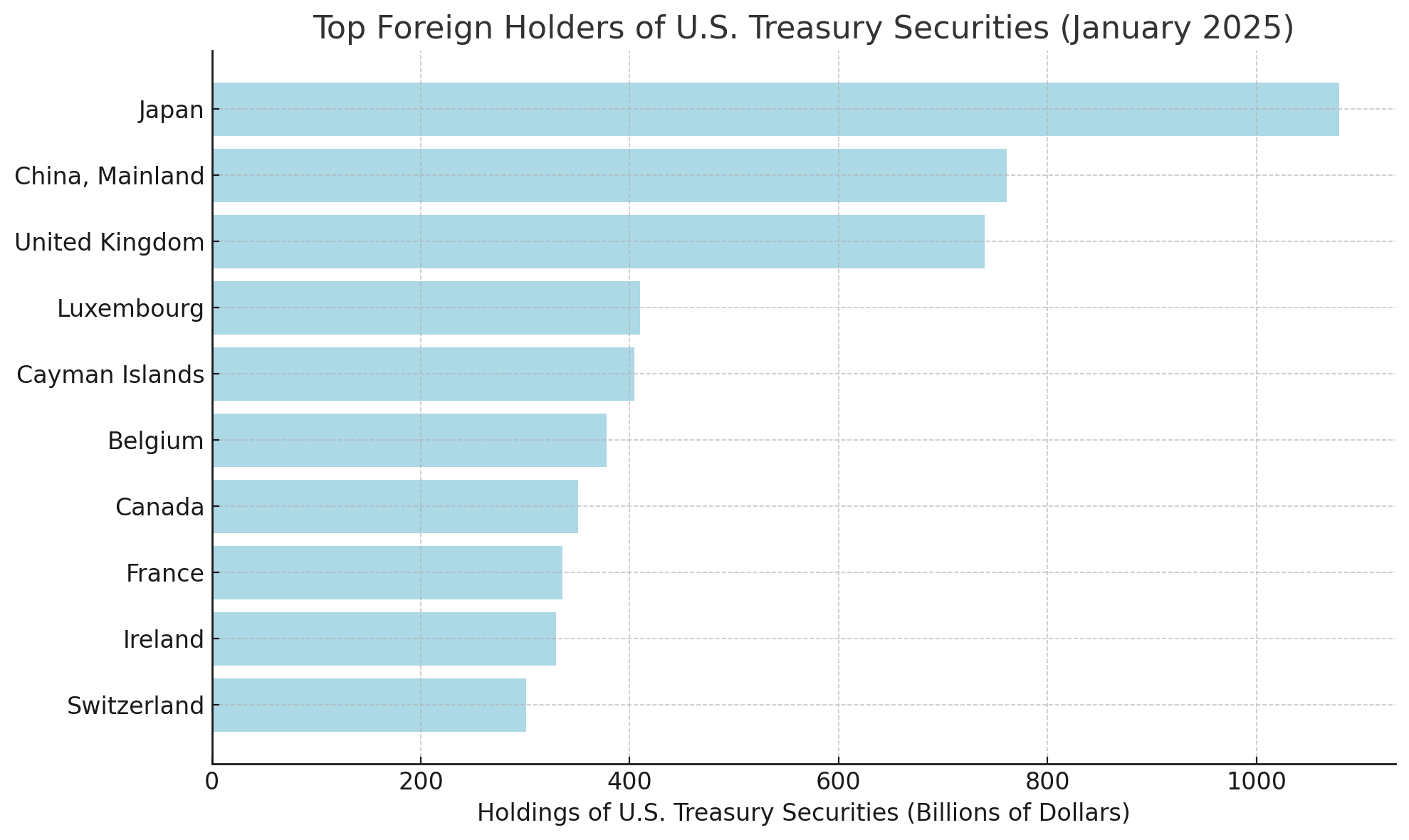

Now, what's causing that? Well the two largest holders of U.S. treasuries are the biggest causes for concern right now in the markets.

China

First, we've got China, they've just ordered their central banks to reduce dollar purchase. But that's not the only thing.

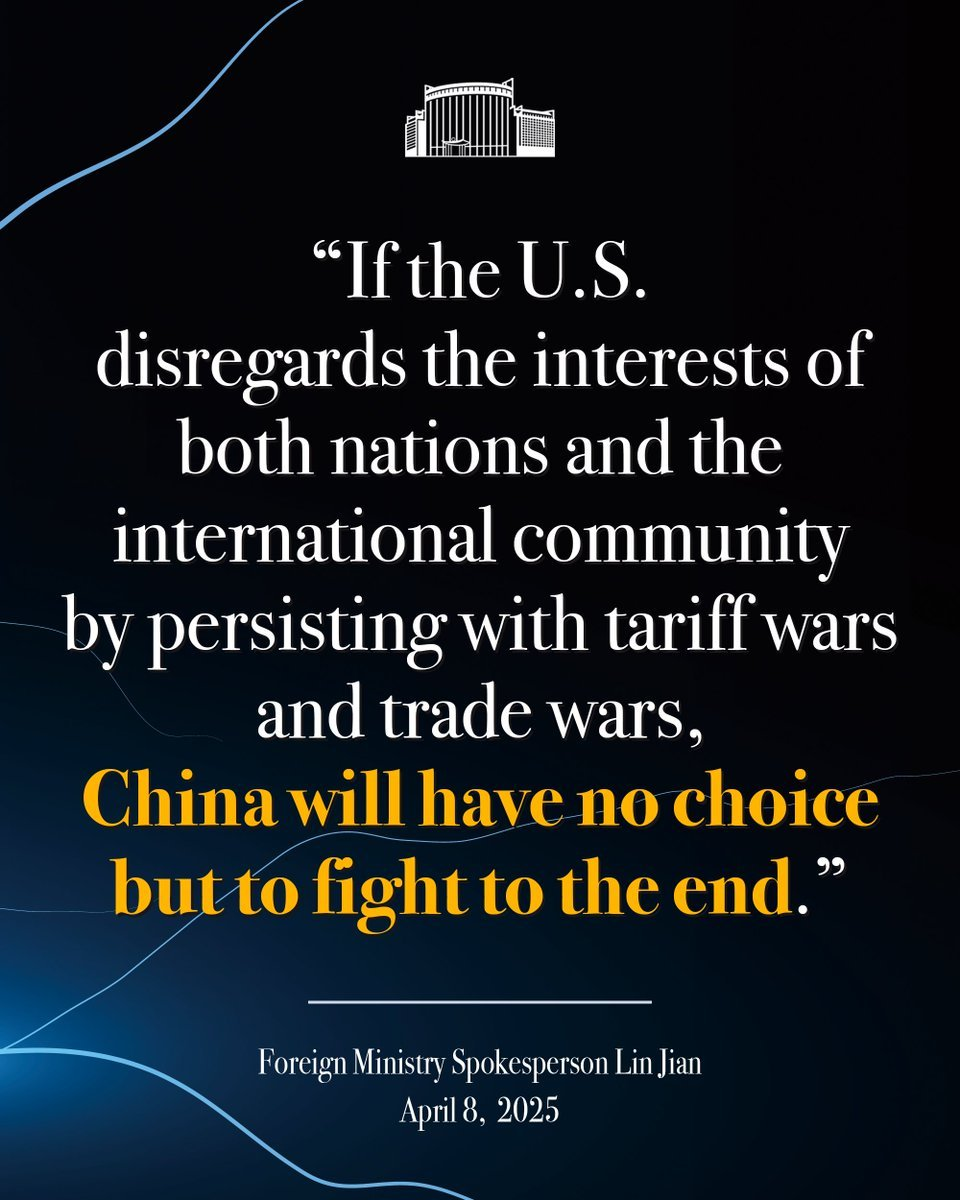

China could be selling U.S. treasuries for two reasons.

The first can be to protect a collapsing Yuan, which has been showing weakness for a while now but the recent tariffs have put added pressure onto it and this can be one of the few options they have to prop it up.

The second however, can be an aggressive move to really fight against the U.S. tariffs in an all out trade war that neither side may be willing to back down from.

By selling off their U.S. bonds and stocks, they are damaging the U.S. economy and putting pressure on the very outcome that Trump so clearly wanted, lower rates to refinance the out of control U.S. debt.

The scary part is these are two superpowers on very aggressive paths right now. It's sad to see people like this in power that have no care for the average person.

Japan

The second situation right now, Japan.

The yen is weak, and bank stocks are crashing hard, down 20% in a week as of early April 2025. Japan owns a ton of U.S. Treasuries, over $1 trillion, but might sell more if things get worse.

It’s like Japan’s banks are scrambling to fix a leaky boat while the storm’s still raging!

Some banks might be struggling to stay afloat, and selling Treasuries could give them quick cash to handle their problems. The beauty of crypto is you don't rely on these 3rd parties.

Plus, with U.S. policies like tariffs causing uncertainty, Japan might need to adjust its financial moves to keep its economy stable.

What Does This Mean?

Volatility. That's what it means. Nobody has a crystal ball and we can't say what will happen today, tomorrow or even a week from now.

But one things for sure the world is a confused place right now, I think what we are witnessing right now is still aftershock of the excessive money printing during 2020 onwards.

Everything is over leveraged, inflation is unstoppable and it's not going to get any better anytime soon. Infact, it's most likely going to get far worse. Just take a look at this clip of Trump talking about a $1 trillion dollar military budget.

President Trump announces he'll be requesting a record-breaking $1 trillion Pentagon budget.

— Ken Klippenstein (@kenklippenstein) April 8, 2025

"$1 trillion, and nobody's seen anything like it. We have to build our military and we're very cost conscious. But the military is something that we have to build, and we have to be… pic.twitter.com/WkGoNrUytW

The war machine is just getting started. The printers are just about to warm up, the federal reserve will be forced to take action soon.

Now, I won't get too much into the fearmongering as there's a lot I can say right now, let's focus on crypto.

👀 Still on the free plan?

You're only seeing the tip of the iceberg.

Unlock the full Learning Crypto experience — including premium insights, trade alerts, and members-only strategies — designed to keep you ahead of the curve.

Get 50% off your paid membership.

What Can You Do?

DCA. Protect yourself. Crypto was built for these exact situations.

Yes, we might see extreme volatility and the price could definitely dip further. But over the long run, if you're willing to see it out over a few years then times like this tend to be golden opportunities.

Bitcoin was made to be the alternative to the traditional systems and what we're seeing across the world right now is essentially a currency war.

It could be the beginning of the end for fiat as we know it. But perhaps I am being too bullish on the timeline for this to unfold and optimistic on the adoption of crypto.

But when you think about it, there really is no other option where you can truly take complete control of your finances and use your money however YOU want to, at any moment in time.

The future of crypto is just getting started and decentralized finance is opening up that world we need to never use banks again.