Global recession, markets crashing, crypto is dead. Except it's not.

If you feel scared right now, don't panic. It's normal. And to be honest, these are usually the times that you should be excited and ready to buy the dip.

There's so much to unpack from this week and if we take a deeper look, it might give us some insight into where we're heading.

Trump's Tarrifs

Now, it's quite obvious what the catalyst for the recent dump has been. Tariffs.

These are a very high risk move from Donald Trump, but the truth is, the U.S. is quite desperate right now. They know the debt is uncontrollable, the dollar is losing its grip of power over the world as BRICS and other nations unite to move away from it.

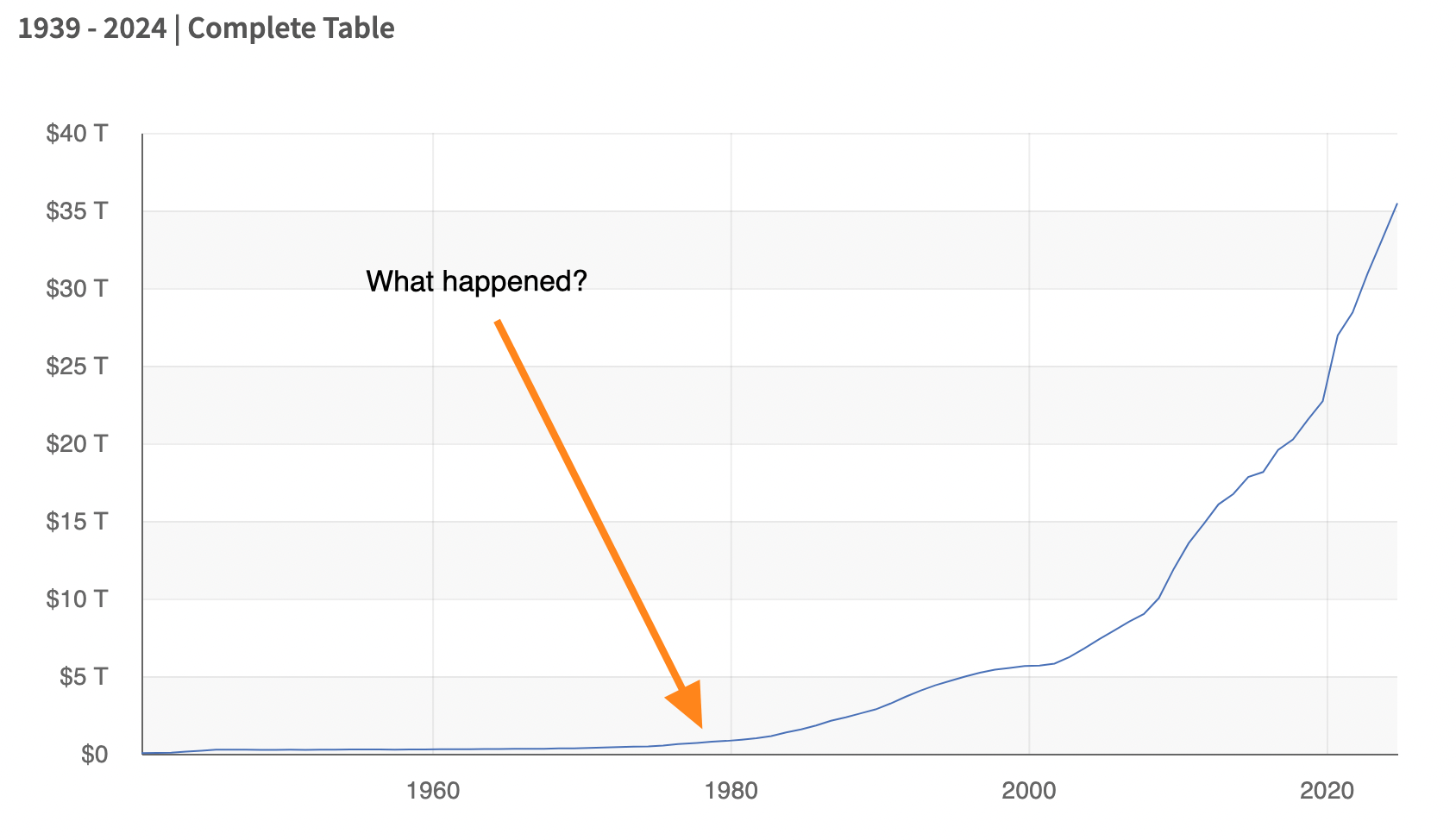

Just take a look at this chart, it's been going parabolic since 1979. Do you know why?

The gold standard was lost. The U.S. led in 1971 by moving away from it, but the rest of the world followed in 1979 and the current fiat system we have today was born.

So why is this relevant to tariffs? Trump knows the path the U.S is on is unsustainable and is doing anything he can to try and prevent the inevitable.

Is it too late? Only time will tell.

But one thing is for sure: Bitcoin has shown incredible strength so far during this time. Still sitting around $83,000, that is incredible. The U.S stock market has had some of its worst days in history, but Bitcoin has barely been affected.

Are we entering into a new era, where Bitcoin is the standard for safety and trust?

What Are Reciprocal Tariffs?

Reciprocal tariffs are proposed U.S. import taxes designed to level the playing field in trade. They're meant to fix trade imbalances—basically, when the U.S. buys a lot more from a country than that country buys from the U.S.

Why Are They Needed?

The U.S. has had big trade deficits (buying more than selling) for over 50 years. The government argues this is partly because other countries make it harder to sell American goods—either through high tariffs, tricky regulations, or other barriers like taxes and currency manipulation.

These issues have:

- Closed over 90,000 U.S. factories since 1997

- Shrunk the U.S. manufacturing workforce by more than 6.6 million jobs

How Are the Tariffs Calculated?

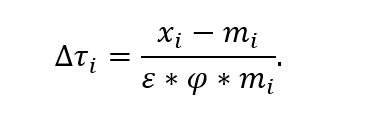

Rather than trying to analyze every little rule or tax in other countries (which is extremely hard), they simply ask:

"What import tax would stop the U.S. from having a trade deficit with this country?"

They use math models and trade data to come up with this number. The result? A range of potential tariffs, depending on the country and trade gap.

What Do The Symbols Mean?

τᵢ (tau sub i): The tariff rate the U.S. applies to country i.

∆τᵢ (delta tau sub i): The change in the tariff rate on imports from country i (i.e., how much the tariff is increased or decreased).

ε (epsilon): The elasticity of imports with respect to price – tells us how much demand for imports drops when prices rise.

→ Value used: 4 (meaning a 1% price increase leads to a 4% drop in import volume).

φ (phi): The pass-through rate – how much of the tariff gets passed on as an actual price increase.

→ Value used: 0.25 (meaning only 25% of the tariff shows up in retail prices).

mᵢ (m sub i): Total imports the U.S. buys from country i.

xᵢ (x sub i): Total exports the U.S. sells to country i.

Key Stats

- Average reciprocal tariff: 20% (unweighted) or 41% (weighted by import size)

- Average for just countries with trade deficits: 50% unweighted, 45% weighted

- These numbers reflect how much the U.S. might need to tax imports to even things out.

Bottom Line

This is the U.S. government saying: “If other countries make it hard for us to sell to them, we’ll raise import taxes to even things out.” It’s part of a strategy to bring more manufacturing and jobs back to America. Will it work? Who knows.

Ethereum Is Dead

A familiar tune lately is ‘Ethereum is dead.’ But that couldn’t be further from the truth. Everyone and everything is building there right now, hardcore.

Why doesn't the price reflect that? Manipulation.

There is no other word for it right now. All the major institutions are accumulating it, building there and one other thing that few are talking about. Stablecoins.

Stablecoins are a huge narrative for the world right now and the U.S. is pushing everything they can into stablecoins and few are talking about WHY.

The U.S knows the dollar is struggling, but by pushing heavily on stablecoins it gives them a chance. They want to cement the dollar as the global currency for trade, whether that's across blockchains or fiat, they don't care right now. It's smart from their point of view. But that's not the only thing.

CBDCs.

Notice that the word has essentially been switched out for stablecoins. They have the same control, except it's in the hands of the government and institutions directly. Imagine the power they would have with global control of every single dollar out there in circulation, it's pretty scary.

But from the perspective of the government, why wouldn't they pursue that?

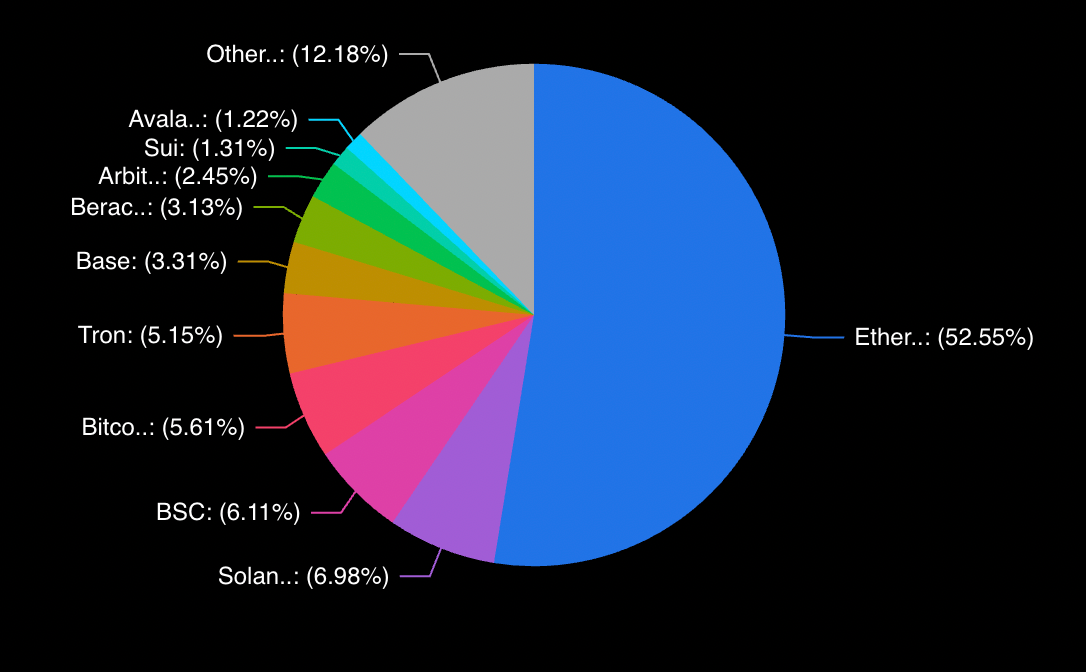

That's why there is an intense focus on Ethereum right now for BlackRock and the other big institutions. It's the home of DeFi right now. Just take a look at the pie chart, over 50% of DeFi is on Ethereum.

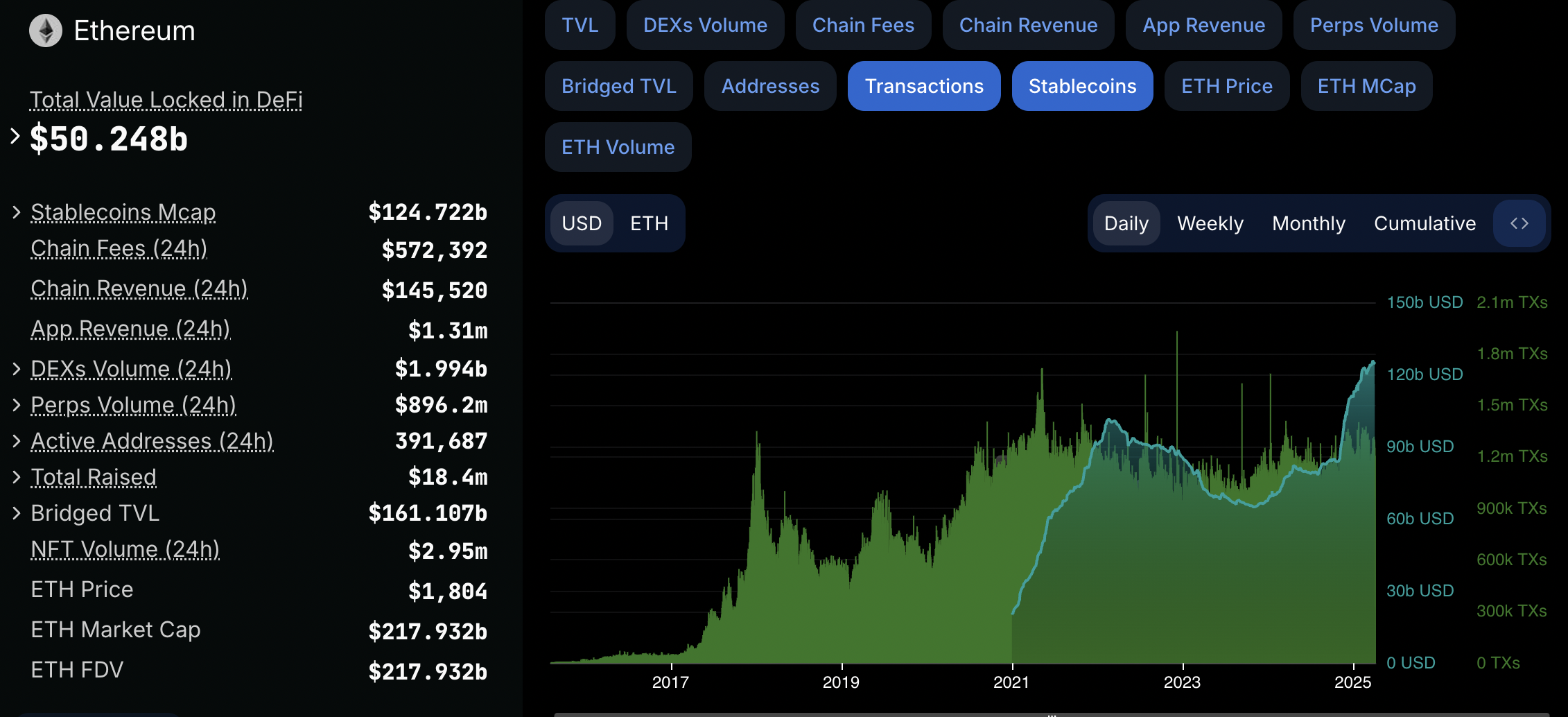

And what else is on Ethereum? Stablecoins. $124 BILLION worth to be precise, an all time high.

And what else? Real World Assets.

Who wants to lead tokenizing everything? BlackRock.

🚨Breaking: Tokenization is bonds and stocks is crazy. It will democratize more Finance - Larry Fink

— Real World Asset Watchlist (@RWAwatchlist_) January 29, 2025

BlackRock loves #RWA 🔥 pic.twitter.com/LiE5Txgwja

And they're doing it all through the BlackRock "BUIDL" fund / securitize. If you want to check it out for yourself, it's here.

These are unprecedented times we are heading into, but it's quite clear Ethereum isn't going anywhere for the time being.

There's definitely going to be a tough battle for control over it going forward though, so strap in for that.

Now let's take a look at how it's performing against Bitcoin.

ETH/BTC

It's been pretty clear for a while now that Ethereum has been bleeding value to Bitcoin. BTC is the king afterall.

But if you take a look at the chart below, you can see we are heading into some really oversold waters right now. A reversal can be imminent anytime now, but the bottom may not be in yet.

Either way, the price of Ethereum both in BTC and USD is very attractive right now, especially if you have a long term view to hold it in the worst case scenario.

But the RSI, Fibonacci retracement, sentiment are all close to ALL TIME LOWS. These are key signs that the bottom could be in soon.

The best indicator out of them? Sentiment. Everybody is saying Ethereum is dead right now, it has no future.

Yet everyone is there, building, growing, and scaling it. The cost to transact on Ethereum now is really cheap in comparison to its highs, yet the actual number of transactions is close to all time highs.

Do not underestimate this, Ethereum is scaling right underneath everyones nose and nobody wants to admit it.

Now, that's everything for this weeks update. But let me know what you think, are you bullish on Ethereum right now or do you think it's dead?