Welcome to your Weekly Crypto Report! I’m glad you’re here because, honestly, things got pretty wild in the crypto world this week.

But don’t worry—I’ll break down exactly what's going on so you can stay informed, empowered, and ahead of the game.

Let's dive in!

Quick Market Check

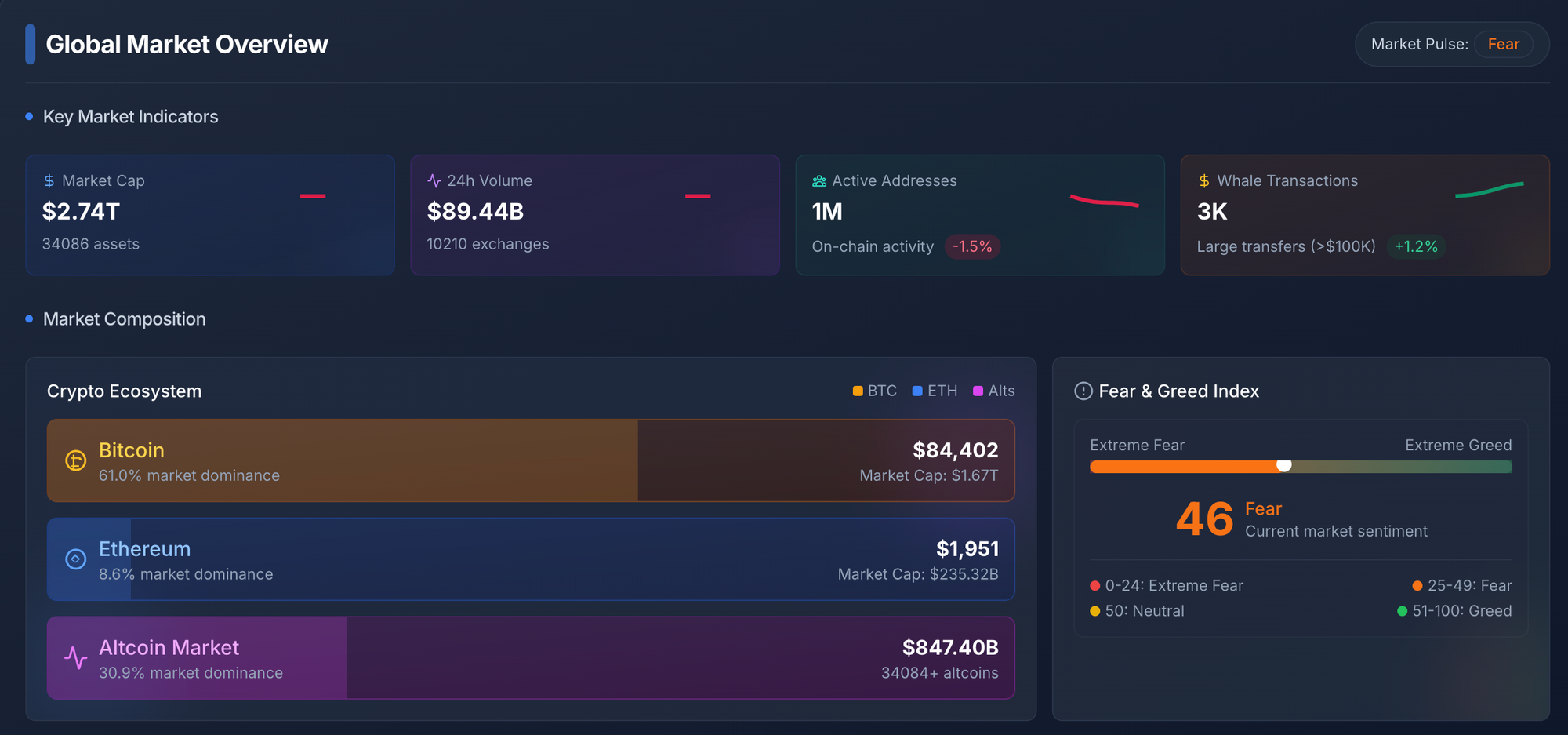

This week, the overall crypto market dipped slightly, settling at around $2.74 trillion. Investors are feeling cautious, shown by the Fear & Greed Index sitting at 46, indicating fear in the market.

Trading volume has been steady, reaching $89.44 billion in the past 24 hours. Active addresses slightly decreased by 1.5%, suggesting less user activity overall.

On the bright side, whale transactions (big-money trades over $100K) actually rose a bit, up by 1.2%, indicating that large investors might be quietly making moves behind the scenes. Bitcoin continues to dominate the crypto landscape, holding strong at 61% market dominance.

How the Big Coins Performed

- Bitcoin: BTC dropped about 8% to around $84,402 this week. Why? Well, the U.S. government’s new tariffs and the announcement of a "Strategic Bitcoin Reserve" made traders nervous, causing some investors to cash out. Interestingly, some big institutional funds started quietly buying again after a week of selling, hinting they see this drop as temporary.

- Ethereum: ETH had an even tougher week, dropping roughly 17% to around $1,951. Investors moved away from riskier altcoins and back toward Bitcoin or stablecoins due to global uncertainties. Despite Ethereum's solid long-term value (thanks to DeFi and layer-2 adoption), it's feeling the pressure just like BTC.

- Cardano (ADA): ADA saw a dramatic rollercoaster—first soaring 80% after the U.S. included it in its new crypto strategy, then falling sharply by about 23%, down to around $0.73.

What’s Influencing Crypto Right Now?

- Global Economics: Crypto prices are closely tied to global news these days. With trade tensions and ongoing worries about inflation, investors are cautious. Higher interest rates (thanks to inflation) usually mean less money flowing into risky assets, including crypto. But that could be about to change.

- Technical Analysis (Easy Version): Bitcoin needs to hold around $82,000–$80,500, or else it might slide further down. For Bitcoin to bounce back convincingly, it needs to climb and hold above the $85,000 mark. Ethereum faces a similar situation around the $1,850–$1,800 support zone. If it manages to climb back above $2,000, things might start looking up again.

Keep an eye on these critical numbers, but don't forget its just noise in the long term!

Big News Highlight: Stablecoin Regulations or Hidden CBDC?

This week, governments in the U.S. and Europe are moving quickly to regulate stablecoins—digital currencies pegged to traditional currencies like the dollar or euro.

In the U.S., the Senate Banking Committee passed the GENIUS Act, claiming it will help stablecoins integrate safely into the financial system. Europe is also tightening its grip through the MiCA regulation, forcing platforms like Binance to remove certain stablecoins from their markets.

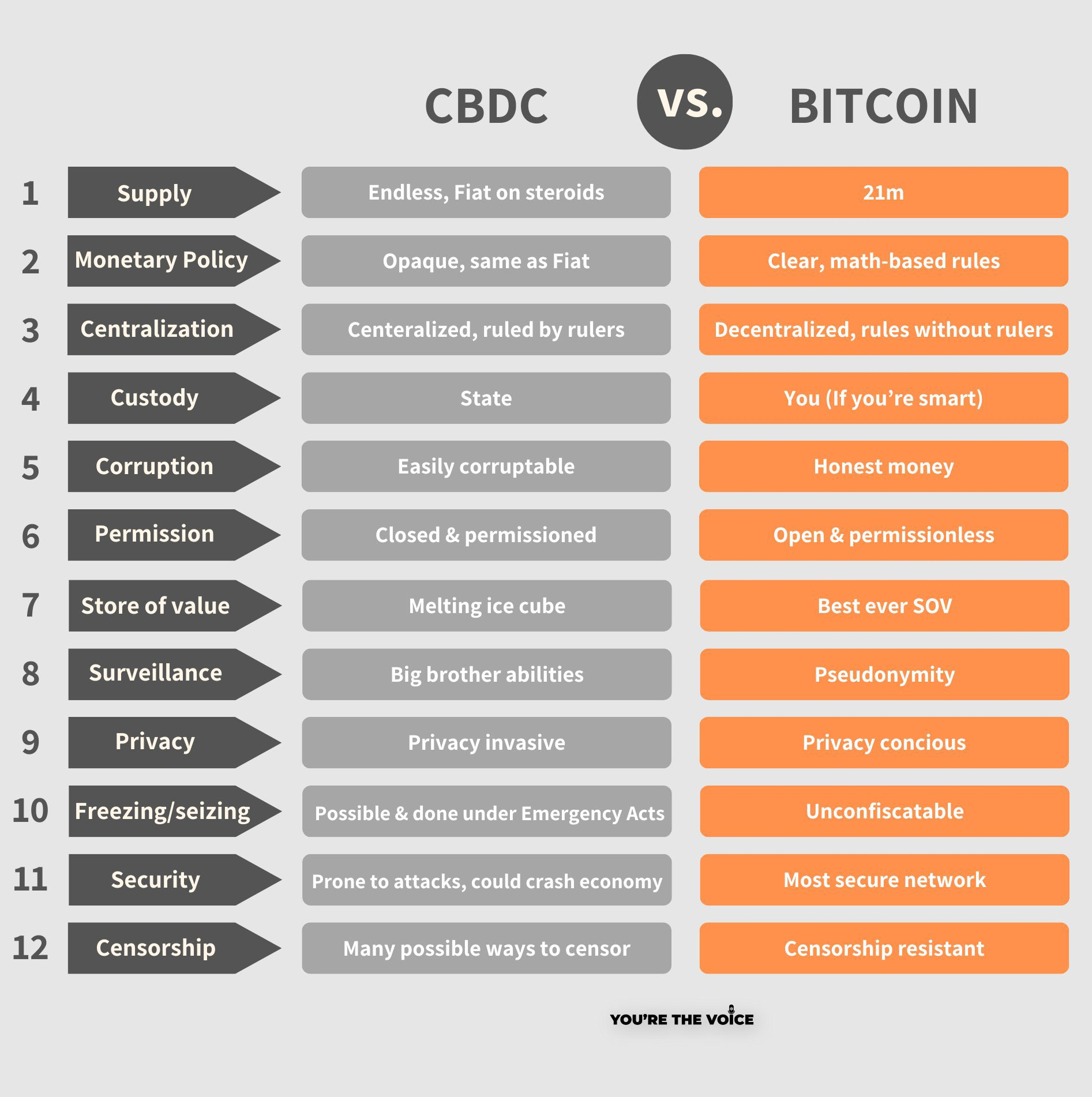

Here’s why this matters to you: While regulation sounds positive, there’s a hidden side to it. These rules might be setting the stage for a Central Bank Digital Currency (CBDC)—basically a fully digital form of government-controlled money. Unlike decentralized cryptocurrencies like Bitcoin, a CBDC gives governments the ability to closely monitor and control how people spend their money.

Europe is openly moving toward launching its own digital euro by October 2025. The U.S. isn’t far behind. This raises real concerns about financial freedom and privacy. Once these regulations are in place, governments could easily start using these digital currencies to track transactions, freeze accounts, or even manipulate your financial decisions.

So stay alert and informed. As crypto enthusiasts and believers in financial sovereignty, we need to ensure that innovation doesn't become a disguise for tighter control and surveillance by centralized powers.