Crypto is once again doing what it does best—testing conviction, exposing frauds, and separating paper hands from diamond hands. The past week has been a bloodbath for retail but a buffet for the real players who understand how these cycles work.

Big money is making its moves while retail is distracted by noise. Institutions are quietly accumulating, regulators are backing off, and Aave is cementing itself as DeFi’s central bank. Meanwhile, memecoin degenerates just got wrecked beyond recognition (and honestly, they deserved it). It's good to see some leverage taken out across the board. This is how crypto works: the herd gets slaughtered, the smart get richer.

And here’s the thing—you don’t get rich by following the herd. You get rich by understanding what’s really happening behind the scenes, and that’s exactly what we're breaking down today. This week, Bitcoin holders were tested, DeFi powerhouses consolidated their dominance, and the most overhyped corners of the market collapsed. If you’re still confused about where the smart money is heading, pay attention—because this is where the game is actually won.

📉 Market Performance

- BTC: -7% | Now: ~$85K | ETF outflows slowing, whales accumulating

- ETH: -10% | Now: ~$2,300 | Institutional interest remains lukewarm, but accumulation is increasing

- SOL: -15-20% | Sentiment crushed but on-chain activity still strong

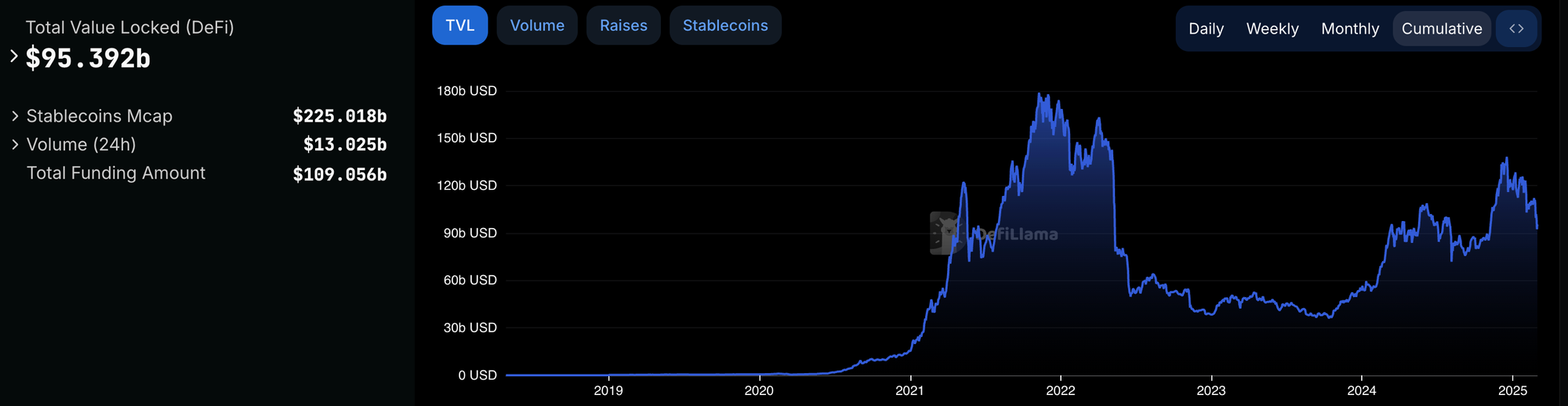

- DeFi TVL: $95B | Aave leads with $17B+ locked

🔥 Key Takeaways

- Regulators Blink First – The SEC dropped lawsuits against Coinbase and Uniswap. Robinhood got cleared of its crypto probe. Why? Because Washington finally figured out crypto isn’t going away—so now they want a piece of it.

- Solana’s Wreckage, Ethereum’s Drift – SOL plunged 15-20%, but on-chain fee revenue remains high, proving network usage persists. ETH fell 10%+, lagging BTC, but ETH whales are accumulating—front-running a rebound.

- Aave’s DeFi Domination – $30B+ TVL, GHO stablecoin grows 30%, multi-chain expansion accelerates. Aave is quietly eating DeFi alive—this isn’t speculation, it’s happening now.

- Wall Street’s Slow Crypto Takeover – State Street & CitiBank enter crypto custody. University endowments are buying BTC. Rockefeller Foundation is considering allocation. The trad-fi invasion continues.

- Security Risks Back in Focus – A $1.5B hack on Bybit shakes confidence. If you’re still trusting centralized platforms, you deserve what’s coming.

Inside the Bybit Hack: How Lazarus Pulled Off a $1.5B Heist

One of the largest crypto hacks in history just unfolded, and if you still keep funds on centralized exchanges, this should be your wake-up call. The Lazarus Group, the infamous North Korean hacking syndicate, executed a sophisticated exploit on Bybit, successfully stealing 401,346 ETH (worth $1.4B at the time).

Lazarus Group just connected the Bybit hack to the Phemex hack directly on-chain commingling funds from the intial theft address for both incidents.

— ZachXBT (@zachxbt) February 22, 2025

Overlap address:

0x33d057af74779925c4b2e720a820387cb89f8f65

Bybit hack txns on Feb 22, 2025:… pic.twitter.com/dh2oHUBCvW

Here’s how they did it:

- Social Engineering Attack – The hackers infiltrated Bybit’s security by tricking key employees through phishing attacks, gaining access to the internal approval process.

- Manipulating the Cold-to-Warm Wallet Transfer – Bybit was conducting a routine funds transfer from its cold wallet (offline storage) to a warm wallet (semi-online for active trading). The hackers intercepted this process, modifying transaction approvals without extracting private keys.

- Transaction Misdirection – Using an exploit in the signing mechanism, they disguised fraudulent withdrawals as legitimate internal transfers, tricking Bybit’s approval system.

- Laundering Through Mixers & Cross-Chain Transfers – The stolen ETH was quickly moved through crypto mixers and multiple blockchain bridges, making it nearly impossible to track or recover.

But the main message here is SELF CUSTODY.

If you are still using an exchange to store your crypto, it's time to get it off. If you want to use either of the wallets we recommend then it's Trezor or BitBox.

Project Spotlight: Aave – The DeFi Powerhouse

Amid market turbulence, Aave remains a pillar of stability and a dominant force in DeFi. While speculation in altcoins and memecoins fades, serious capital is flowing into protocols with real utility.

Here’s why Aave’s macro position remains unshaken:

- $18B+ TVL and Climbing – Aave continues to dominate the DeFi lending sector, with over $18 billion locked across multiple chains. This isn’t just a number—it signals trust, liquidity, and real institutional adoption.

- GHO Stablecoin Expansion – The Aave-powered GHO stablecoin is growing in demand especially with the need for decentralized stable assets. As regulators tighten their grip on centralized stablecoins, GHO’s adoption is accelerating.

- Multi-Chain Expansion – Aave isn’t just an Ethereum-native project anymore. It has expanded to Optimism, Arbitrum, Avalanche, and now Base, Coinbase’s Layer-2 chain. The goal? Capture liquidity wherever DeFi thrives.

- Institutional Trust is Growing – The Ethereum Foundation recently deposited $27M worth of ETH into Aave, a strong signal that blue-chip DeFi protocols are seen as safe and viable for long-term asset deployment and to earn a yield on your crypto.

So if you don't have any AAVE exposure, now might be a good time to slowly consider accumulating.

And if you have no idea what AAVE is still, check out the complete guide Heidi did recently:

Final Thoughts

If you made it this far, congratulations—you’re already ahead of 99% of crypto market participants who are too busy chasing hype instead of understanding where real value is accumulating. The market is brutal, but those who see the bigger picture always come out on top.

✅ Bitcoin at $85K is still cheap if you understand the macro shift.

✅ DeFi isn’t dead—Aave proves that real utility is growing.

✅ Security matters more than ever—get your coins off exchanges.

Also, a quick shoutout—our new “End The Fed” T-shirt is out now! You can grab yours for just $19.95, and yes, we now accept crypto payments in the store.