Can you believe just a few days ago, Bitcoin was below $75,000 for the first time in 2025 and the sky was falling. Now, today, it's sitting just under $85,000 and everybody is bullish again.

Do NOT get comfortable.

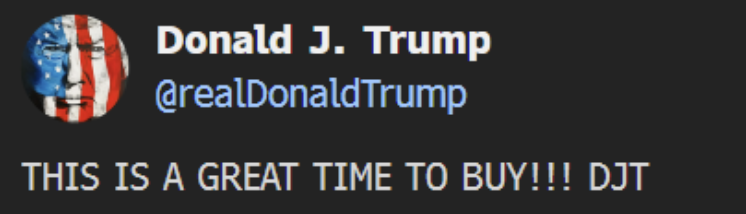

There has been clear manipulation, Trump posted this on his Truth social account a few hours before announcing the tariff pause.

Now there's been an exemption on the tariff with China: Smartphones, chips and various electronics.

There is also a lot of speculation right now that the recent market pumps is a retail trap and there is more pain to come. I know this isn't quite relevant to crypto, but it's hard not to focus on this glaring topic. In the short term the volatility can affect the crypto markets too.

The only issue for the U.S. President is that the tariffs seem to have had the opposite effect they wanted, the treasury yields have been exploding. Currently up to 4.877% on the 30 year. Their goal to refinance the exploding debt at low rates is not looking good right now.

Stick to your strategy, DCA when appropriate. Now, let's get into this week's report.

Crypto, Where Do We Go From Here?

The total crypto market cap is currently down around 37% from its all time high in December, around $1.37 Trillion.

Now, what's interesting about this though is it's -22% down from the 2022 all time high. But Bitcoin is still well above that for now.

So that brings us on to the next key focal point.

BTC dominance

We recently highlighted the fact that, if the past is anything to by, Bitcoin dominance tops out around 70%.

Now, that definitely does not mean it needs to go that high. But if you take a look at the chart below, it's been continuing to climb and breach through a significant level which has been both a point of resistance and support in the past.

Are we about to see the blow off top for BTC dominance? Now, it may seem extreme to be calling for alt season right now. But if this chart is anything to go by then it could certainly be around the corner.

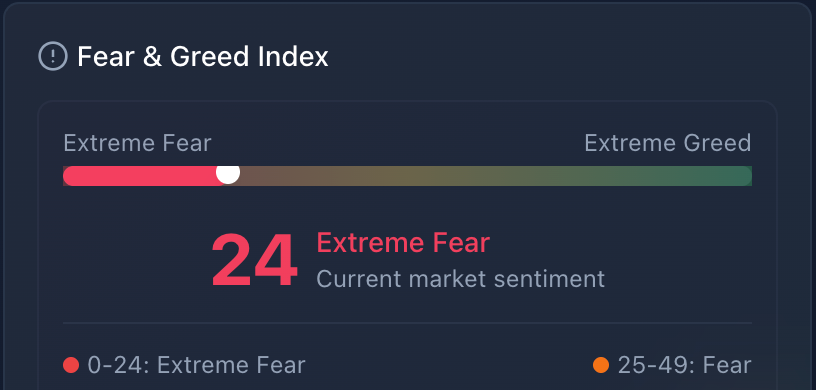

These things tend to happen when it's least expected and right now the sentiment is terrible. Take a look at the Fear and Greed index below.

One thing you must keep in mind right now though is that altseason does not necessarily mean the dollar value of alts will go crazy, it's the BTC pairs that need to be focused on during these times of volatility.

ETH/BTC Pair

Everybody knows that Ethereum has been a sitting duck this cycle, completely underperformed everyones expectations.

So I want to highlight the ETHBTC pair.

It's down almost 80% from its 2021 high. That's insane.

The sentiment has also died with it. People are even calling Ethereum a relic right now. Which is far from the actual truth.

The RSI has also fallen off a cliff, the price of ETH valued against BTC is incredibly attractive right now. Could there be further downside? Yes, of course. But the risk to reward right now is looking good.

The Dark Horse - Monero

Monero has been riding this recent storm like a champ. Since November it's actually been outperforming Bitcoin too.

During times like this when the world seems to be closing in on itself and attacking privacy, Monero is a real savior here. It has been delisted from most exchanges, do you know why? Because it works.

It's been hovering around the $200 mark for a while now and to be honest there aren't enough privacy options out there at the moment and this is certainly the leader in that aspect.

🎁 You're invited: Unlock premium with 50% off

We built Learning Crypto Premium for serious learners, traders, and future-focused investors.

This offer is exclusive to newsletter subscribers like you.