We’ve been digging into the institutional breakdown between Bitcoin and Ethereum—two of the only assets actually attracting real institutional capital right now.

What we found was... surprising.

Market snapshot

First, let’s establish the high-level view. Bitcoin still dominates in absolute dollar terms, but Ethereum has quietly become institutionally dense.

Much of this is due to Ethereum’s role in tokenized U.S. Treasuries—led largely by BlackRock’s BUIDL fund.

| Exposure Bucket | Institutional | Retail | Inst. % |

|---|---|---|---|

| Bitcoin | $84.9B | $72.3B | 54% |

| Bitcoin (ex‑MSTR) | $39.5B | $72.3B | 35% |

| Ethereum | $5.8B | $1.2B | 82% |

| MicroStrategy (Solo) | $45.4B | — | 100% |

*This includes ETF exposure, public corporate holdings, and tokenized assets on-chain (primarily U.S. Treasuries via Ethereum).

🧠 Context That Matters

Here’s what stands out:

- Bitcoin appears institution-heavy at 54%, but that number collapses to just 35% if you remove MicroStrategy.

- Ethereum shows an 82% institutional ratio—not because of balance sheets, but because of RWA tokenization and fund mechanics.

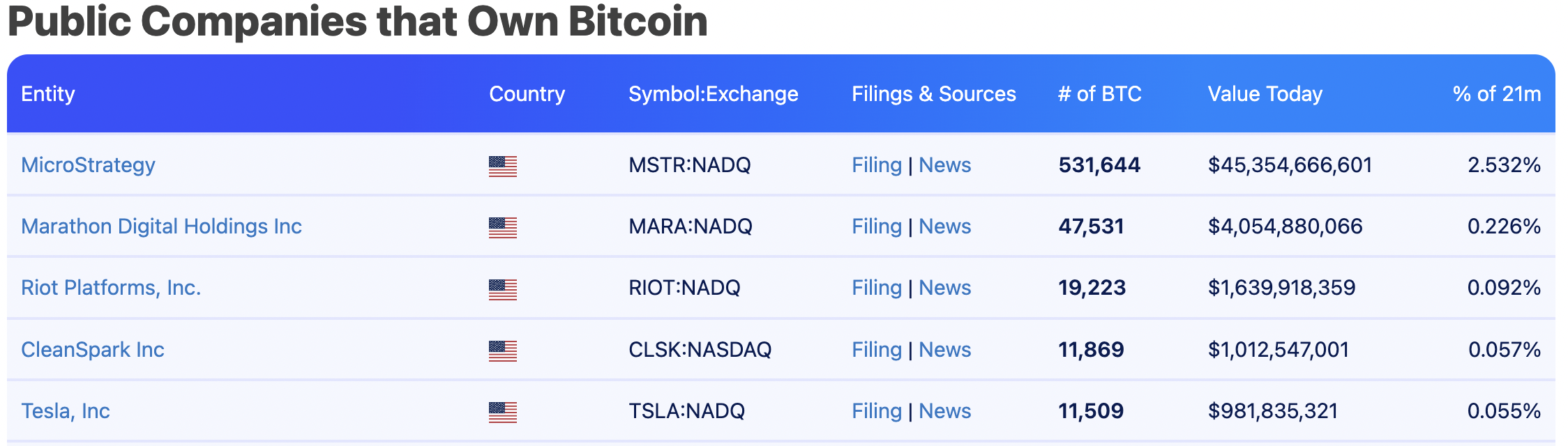

There’s now a >10× gap between MicroStrategy and the next closest corporate holder, Marathon Digital (47,531 BTC vs. 531,644 BTC).

Was Saylor expecting others to follow? Maybe. But that wave hasn’t come yet.

It might still be early—or it might be a ceiling.

Was Saylor expecting there to be a wave of institutional fomo following him? It does not seem that is quite the case at the moment, as we will get into in the next section. Now, it could be a nothing burger, but it's certainly something to keep an eye on.

ETF Breakdown

Bitcoin ETF inflows continue, supported by strong retail demand. Ethereum ETF assets have dropped with the spot price, but institutionals are still buying nearly half of what’s left.

| Metric | Bitcoin ETFs | Ether ETFs |

|---|---|---|

| AUM | $96.9B | $2.3B |

| Institutional slice | $24.6B (25.4%) | $1.1B (47.7%) |

| Y‑t‑d flow | +$29.3B | –$0.4B |

| Largest fund | IBIT $42.6B | EETH $0.7B |

It’s now obvious that Bitcoin is ahead in dollar terms. No question there.

But when you strip out MicroStrategy, the gap in institutional participation starts to shift.

Ethereum might not have the market cap, but the percentage of smart capital in ETH is something to watch closely—especially if staking gets SEC clearance in the U.S.

That one ruling could turn Ethereum into a yield-bearing, institution-optimized vehicle overnight.

We’ll keep tracking the flow.

Tokenized U.S. Treasuries on Ethereum

The fastest-growing on-chain institutional asset class isn’t a token, a Layer 2, or even a stablecoin—it’s tokenized U.S. Treasuries, and it’s almost entirely on Ethereum.

Over 90% of tokenized Treasuries now live on Ethereum, and the category just crossed $4.6 billion in AUM. That’s up over $1 billion in the past 30 days, thanks in large part to one name:

BlackRock, of course.

Their recently launched BUIDL fund, issued on Ethereum, is already the dominant wrapper—more than doubling the AUM of all previous tokenized treasury products combined.

| Wrapper | AUM | Launch |

|---|---|---|

| BlackRock BUIDL | $2.47B | Mar 2024 |

| Franklin BENJI | $0.70B | Apr 2024 |

| Ondo OUSG / USTB | $1.04B | Jan 2024 |

| Other issuers | $0.42B | 2023‑24 |

| Total | $4.63B |

Stablecoins: Infrastructure or Infiltration?

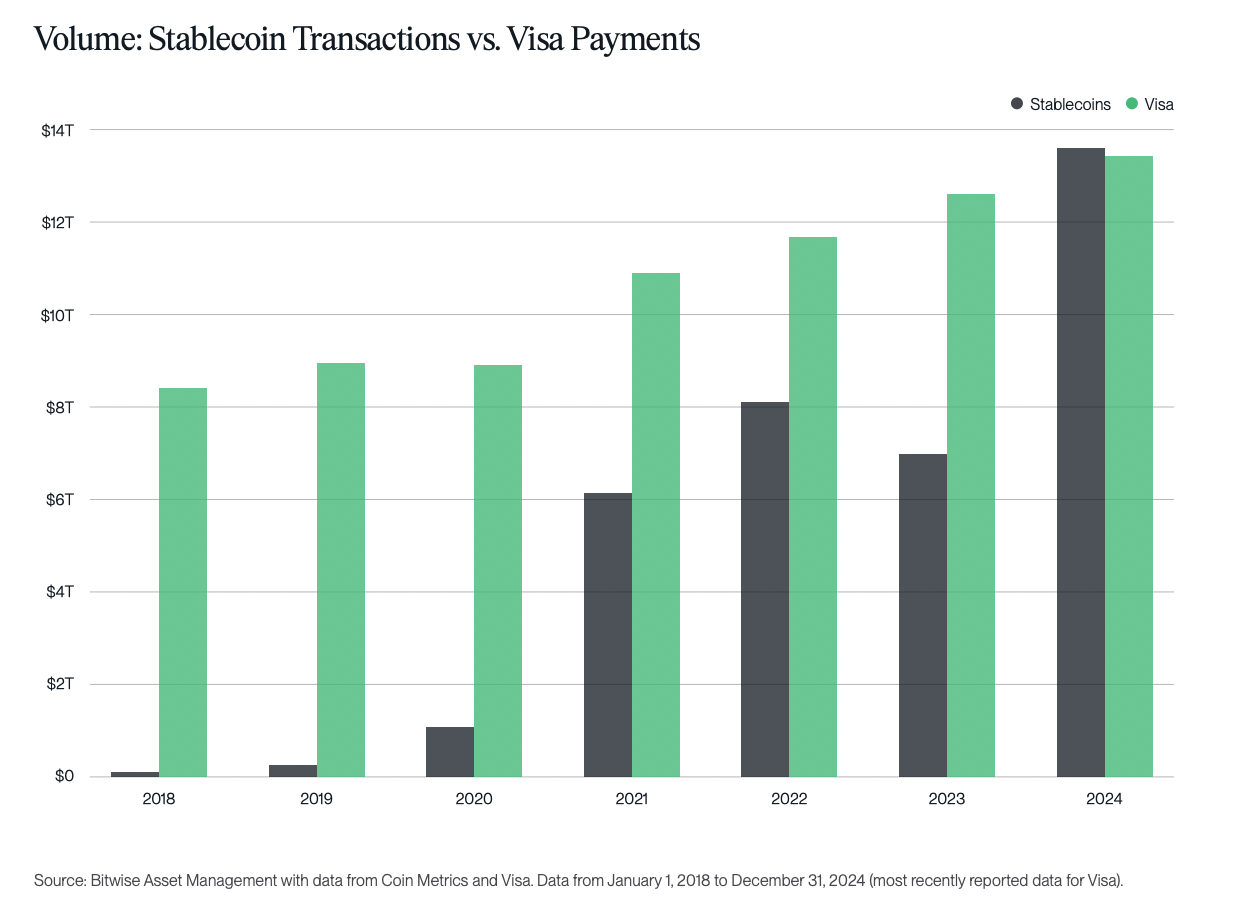

Stablecoins just posted their strongest quarter ever. According to Bitwise’s Q1 2025 report:

- Stablecoin AUM hit an all-time high of $218B, up 13.5% QoQ

- Stablecoin transaction volume jumped 30.1% in the same period

- The majority of this volume was settled across Ethereum L1 and L2s, not on centralized platforms

These aren’t speculative assets—they're digital dollars moving at network speed, increasingly used in institutional DeFi, payment rails, and RWA infrastructure.

Throughout 2024 they actually processed more value than visa. There are caveats to this as visa processes a lot more smaller transactions at scale, but it's still an interesting piece of data to follow.

But there’s a hidden tension here. What makes stablecoins so effective—speed, dollar-pegging, legal clarity—is also what makes them surveillance-compliant, freeze-prone, and institutionally co-optable.

While U.S. Congress is expected to pass landmark stablecoin legislation by July 2025, this regulatory clarity may also lock in centralized control over what was once meant to be censorship-resistant.

Key questions that remain:

- Can stablecoins truly scale without becoming permissioned financial instruments?

- What happens when Circle, Tether, or future bank-backed issuers are pressured by regulators?

- Will this infrastructure strengthen crypto’s global reach, or turn it into a dollar-wrapped proxy system?

"Don’t trust. Verify." — Cypherpunk motto

And remember, their smart contracts have full control over your stablecoins. They have the power to freeze, blacklist and do whatever they want essentially with the tokens.

Signal In The Noise

And where do we go from here?

Institutional adoption is no longer a narrative—it's observable, on-chain, and in filings.

What we're seeing now isn't about hype cycles or token speculation. It's about capital infrastructure quietly forming beneath the surface—across both legacy vehicles (like ETFs) and emerging rails (like tokenized Treasuries).

- ETFs are absorbing billions in flows, but with very different demand profiles—one largely retail-led, the other split near-even with institutional allocators.

- Tokenized real-world assets are growing faster than most DeFi sectors, with BlackRock and Franklin Templeton deploying directly on-chain.

- MicroStrategy remains a statistical anomaly, but one that heavily distorts the optics of institutional presence if not adjusted for.

From a long-term perspective, the key isn’t picking a chain or betting on a narrative. It’s understanding where real capital is flowing, why it’s flowing there, and which structures survive regulatory friction, latency, and scale.

“You can’t stop things like Bitcoin. It will be everywhere and the world will have to readjust. World governments will have to readjust.”

— John McAfee

Whether or not you align with McAfee’s ideology, the core truth behind that statement is playing out in real time:

Protocols don’t wait for permission. Capital follows utility.

What we’re witnessing isn’t noise—it’s the emergence of a programmable financial substrate, built in the open, adopted quietly, and measured in real dollars, real flows, and real usage.

It’s no longer about hype. It’s about rails.

Stay focused. Watch the contracts. Track the filings.

We’ll be back with the next wave of signals soon.