This week has been packed with announcements so big that just a few years ago would've sent Bitcoin parabolic. But now, it's just another day and the price actually dropped.

Is that the market saying this is NOT the way this space should be heading?

Think about it for a moment, the United States just announce a Bitcoin Strategic Reserve and the price dropped.

Long gone seems to be the days of the cypherpunks now. But with the recent whitehouse announcement, it might actually be the spark we need to ignite a new wave of innovators pushing private, decentralized platforms.

Market Overview

- Market Cap: ~$2.93T (The revolution continues)

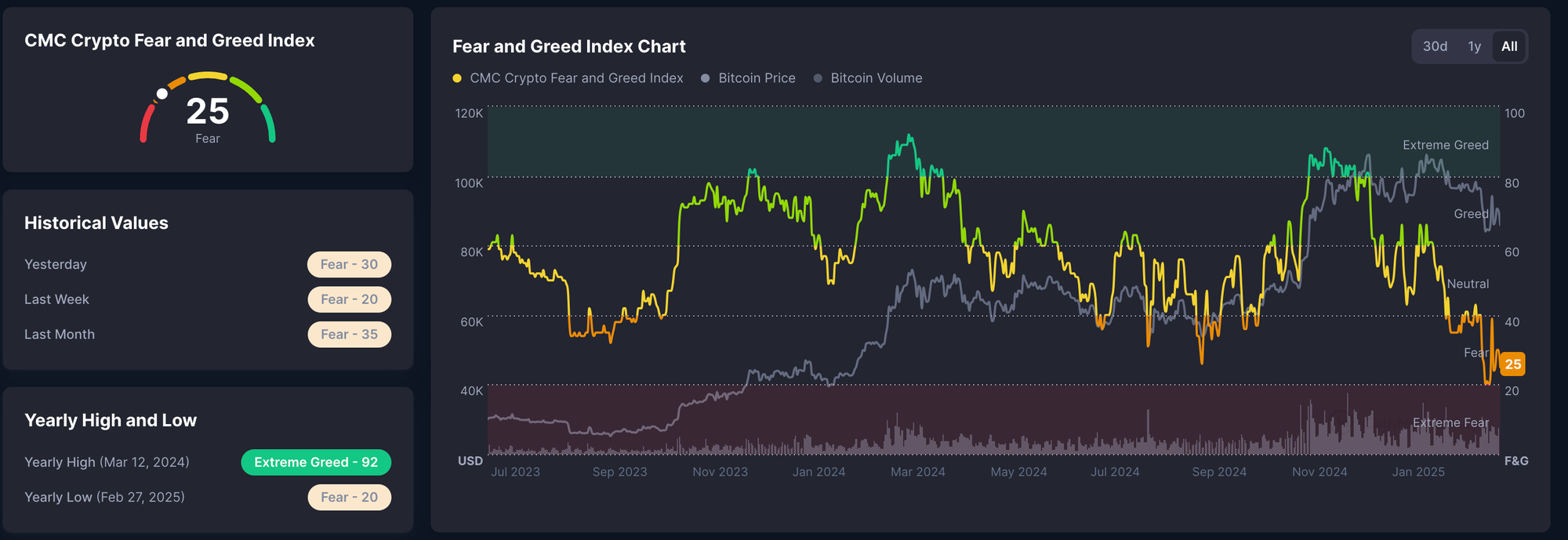

- Fear & Greed: Fear (25). Fear is usually your friend in these markets.

- BTC Dominance: ~58%. Bitcoin is still the strongest asset in crypto right now.

Major Caps

Obviously this week has been a bit of a rollercoaster and it started off strong, but then we're back in the position we were not too long ago. However, I want to remind you here that Bitcoin is still at $86,000 which in the grand scheme of things is INCREDIBLE.

Here's how they've performed over the last 7 days:

- Bitcoin: ~$86,000 (0.7%)

- Ethereum: ~$2,200 (0%)

- XRP: ~$2.34 (+9.1%)

- Solana: $137.22 (-2.3%)

Bitcoin Strategic Reserve

The announcement seemed to be a bit of a disappointment for Bitcoin maximalists. Yes, the U.S. will now be holding Bitcoin in a strategic way, but they have zero plans right now of accumulating more. Only keeping what they have already seized. Here's Toby's breakdown of the whole situation, covering the facts:

Project Spotlight: Monero

Now, with the recent announcements coming out from the government, it makes sense to take another look at Monero right now.

Rules and regulations are going to be coming in hard and fast.

And what's the one project that's being delisted everywhere, because of how POWERFUL the underlying technology is? Monero.

The developers are still actively working on the FCMPs upgrade which is going to enhance the privacy even further. Once that live it becomes a different beast, bulletproof.

Here’s a simple analogy of the change from ring signatures to FCMPs:

- With ring signatures, it’s like hiding in a small crowd of 11 people (a typical ring size in Monero) and saying, “One of us did it!” An observer might eventually figure out patterns to narrow it down.

- With FCMPs, it’s like hiding in the entire population of a city and saying, “Someone in this city did it!”—but without making the proof so huge that it takes forever to check.

Why Are FCMPs Better?

Here’s why Monero devs are excited about FCMPs:

- Better Privacy: They make it much harder for anyone to de-anonymize transactions, since the “mixing pool” is the entire blockchain, not just a small ring.

- Smaller Data: FCMPs can reduce the size of the privacy proofs compared to ring signatures, which means less bloat on the blockchain and faster syncing for nodes.

- Faster Verification: Checking these proofs could be quicker than verifying ring signatures, speeding up transaction validation across the network.

Why Haven’t They Been Implemented Yet?

There are challenges. FCMPs are still in research and development because:

- They’re complex to implement correctly without introducing bugs or vulnerabilities.

- They might require a hard fork to integrate into Monero, which takes community consensus and careful testing.

- There’s debate about whether they’re truly better in all scenarios—some worry about edge cases where they might leak info differently than ring signatures.

Price Performance

The price has been showing some relative strength over the last 6 months or so, even since 2022 its been quite flat. Which is both good and bad. Obviously holding Bitcoin throughout this time clearly outperformed it.

But the fact it's held this price and is now climbing is showing the strength of it.

Sam Bankman Frieds Return!

This week we also got a wonderful interview live from the prison Sam Bankman-Fried is sharing with P-Diddy, who he also said is really nice to him! hmmm, makes you wonder what's going on there.

We wrapped up the highlights from the interview on our X account, so be sure to check them out here and follow us if you don't already to stay up to date with everything.

🚨 SBF JUST DROPPED SOME BOMBSHELLS IN HIS PRISON INTERVIEW

— Crypto Tips (@cryptotipsreal) March 6, 2025

WE'VE CLIPPED THE BIGGEST HIGHLIGHTS 👇

White House Summit

This week also saw the first OFFICIAL white house crypto summit, but to be honest, there's really not much to talk about with that. I can summarize it for you in one picture:

The only thing to come out of it was a clear lack of deep understanding of this space from the President and he was just repeating some of the buzz words people have been telling him.

Now don't get me wrong, it's great to see countries starting to attempt to adopt crypto in their own ways. But we must not forget the original vision of Bitcoin and it certainly wasn't to conform with rules and regulations.

But alas, here we are, I guess an inevitable step of the adoption cycle.

If you want a real deep dive into why we really need crypto, then make sure you check out Heidi's book. It's one of the best out there and really hammers home that original vision. It's not to be missed.

That's it for this weeks report.

Hope you enjoyed it, let me know below what you thought and don't forget to hit those feedback buttons. This is for you after all.

Thanks,

Adam