Why Bitcoin Was Created: An Introduction To Bitcoin

Hey everyone! If you're here to understand the core reasons behind Bitcoin's creation, you've come to the right place. Let's dive right in.

So, why was Bitcoin created? To really get this, we need to go back to 2008. That year wasn't just marked by the release of the Bitcoin white paper; it was also the year of a massive global financial meltdown. The 2008 financial crisis was no accident, and it exposed the deep flaws within our traditional financial systems. Banks and investment firms were caught playing risky games with our money, leveraging debt, and repackaging risky mortgages as top-tier investments. And guess what? When it all came crashing down, it was the taxpayers who had to bail them out, while the big bankers walked away with their golden parachutes.

Bitcoin was born as a direct response to this chaos. It was designed to address the lack of transparency and the redundancy of many positions within the traditional financial world. What Bitcoin offers is an opt-out, an exit from this flawed system. It's a move towards a more free, transparent, and peer-to-peer financial option that eliminates the need for bankers and their unnecessary fees.

Think about it: the financial crisis happened because bankers were operating behind closed doors, doing whatever they could to make money at our expense. Post-crisis, we saw these same bankers receive huge bonuses while ordinary people lost their homes and savings. It was a wake-up call, showing just how broken the system was.

Enter Bitcoin. Created by the mysterious Satoshi Nakamoto, Bitcoin was designed to bypass the need for centralized financial authorities. It’s a system where you and I can transact directly without needing approval from a bank or any other centralized entity. No more middlemen, no more unnecessary fees, and no more asking for permission to use our own money.

In essence, Bitcoin represents a fundamental shift in how we think about money and transactions. It's a revolutionary step towards financial autonomy and transparency, allowing us to regain control over our wealth. And that's why Bitcoin exists.

Who Is Satoshi Nakamoto?

Alright, now that we've covered why Bitcoin exists, let's talk about the enigmatic figure behind its creation: Satoshi Nakamoto. The name that’s now legendary in the world of cryptocurrencies. But here's the kicker—no one really knows who Satoshi is. It could be a single person, a group of people, or something else entirely. Their identity remains one of the biggest mysteries in tech and finance.

What we do know is that Satoshi Nakamoto published the Bitcoin white paper in 2008, introducing the world to a revolutionary new form of digital currency. This white paper laid out the blueprint for Bitcoin, detailing how it would work, and setting the stage for the decentralized network we know today.

Bitcoin's development wasn't a solo effort, though. Many other brilliant minds contributed to the evolution of digital currencies. But it was Satoshi who brought all these ideas together in a way that finally worked. And in 2009, Satoshi released the first Bitcoin software, which allowed people to start mining and transacting with Bitcoin.

What's truly remarkable about Bitcoin is that Satoshi Nakamoto decided to release it as open-source software. This means anyone could look at the code, use it, and even modify it. This openness is a big part of why Bitcoin is so secure and robust today. It doesn’t rely on a single entity for its operation. Instead, it runs on a decentralized network of computers around the world.

So why is Satoshi’s identity still a mystery? Well, there are lots of theories, but no definitive answers. Some believe Satoshi remained anonymous to avoid legal issues or to keep the focus on Bitcoin rather than on themselves. Whoever they are, Satoshi Nakamoto's decision to stay anonymous has only added to the allure and intrigue of Bitcoin.

Satoshi’s last known communication was in 2011, and since then, the identity has remained hidden. Despite this, their creation has grown beyond anyone’s imagination, proving that the power of an idea can indeed change the world, even without a face or a name behind it.

Satoshi Nakamoto’s anonymity doesn’t detract from their contribution; in fact, it enhances the decentralized ethos of Bitcoin. It’s not about who created it—it's about the network, the technology, and the possibilities it unlocks for financial freedom and transparency. And that’s the story of Satoshi Nakamoto, the mysterious creator who gave the world Bitcoin.

Decentralization

Let’s continue our journey by diving into one of the most crucial aspects of Bitcoin: decentralization. This is a key concept that sets Bitcoin apart from traditional financial systems, and it’s what makes Bitcoin truly revolutionary.

Decentralization is all about removing the need for a central authority to verify transactions. In traditional banking, you need a bank or some other central entity to process and approve your transactions. This centralization creates single points of failure and makes the system vulnerable to corruption, manipulation, and inefficiency.

Bitcoin flips this model on its head. Instead of relying on a central authority, Bitcoin operates on a decentralized network of computers, known as nodes, spread all over the world. These nodes work together to validate and record transactions on the blockchain, Bitcoin's public ledger. This means that no single entity controls the network. Instead, it’s maintained by a collective effort of individuals who run these nodes.

Why is decentralization so important?

Well, it brings several key benefits.

First, it enhances security. In a centralized system, if the central authority is compromised, the entire network is at risk. But with Bitcoin, there’s no central point to attack. The network is incredibly resilient because it's spread across thousands of nodes. If one node fails, the others continue to operate without disruption.

Second, decentralization ensures transparency and trust. Since Bitcoin’s ledger is public and can be audited by anyone, there's no need to blindly trust a central authority. Every transaction is recorded on the blockchain and can be verified by anyone, anywhere. This level of transparency is unprecedented in the financial world.

Third, decentralization promotes inclusivity and accessibility. Anyone with an internet connection can participate in the Bitcoin network. You don’t need permission from a bank or government to send or receive Bitcoin. This is particularly powerful in parts of the world where access to traditional banking services is limited or unreliable.

A great analogy to understand decentralization is to think of it like a spider web. The more points of support a web has, the stronger it becomes. If one point is compromised, the web still holds up because the other points maintain its structure. Similarly, Bitcoin’s decentralized network remains robust and secure because it doesn’t rely on any single point of failure.

Decentralization is the backbone of Bitcoin’s security and longevity. It’s what makes Bitcoin a revolutionary technology that challenges the status quo of traditional finance. By distributing power and control across a global network, Bitcoin empowers individuals and promotes a more transparent, secure, and inclusive financial system.

So, that’s decentralization in a nutshell. It’s the core principle that underpins everything about Bitcoin, ensuring that it remains robust, transparent, and accessible to everyone. Stick around as we dive deeper into how this decentralized, peer-to-peer network functions in the next chapter.

Peer to Peer Network

Now that we’ve discussed decentralization, let’s dive into another fundamental aspect of Bitcoin: its peer-to-peer network. This concept is essential to understanding how Bitcoin operates and why it’s so revolutionary.

Bitcoin’s peer-to-peer (P2P) network allows transactions to occur directly between users without the need for intermediaries like banks. In traditional financial systems, banks act as intermediaries that approve and facilitate transactions. This not only introduces delays but also incurs fees and exposes users to the bank's policies and limitations.

In a P2P network, you and I can transact directly. This is made possible by the decentralized nature of Bitcoin, where transactions are verified by nodes spread across the globe. These nodes validate transactions and record them on the blockchain, ensuring that they are legitimate and secure.

Here’s why this is such a big deal:

First, it gives you control over your money. In a traditional system, banks can freeze accounts, delay transfers, or even refuse transactions based on their own criteria. With Bitcoin, you don’t need permission from a central authority to use your funds. This autonomy is a significant shift towards financial freedom.

Second, it reduces costs. By eliminating intermediaries, Bitcoin transactions often have lower fees compared to traditional bank transfers, especially for international transactions. Banks typically charge high fees for cross-border transfers, but with Bitcoin, you can send money anywhere in the world for a fraction of the cost.

Third, it enhances privacy. Traditional banking systems require personal information to process transactions, which can be exposed or misused. Bitcoin transactions, on the other hand, don’t require you to reveal your identity. Instead, transactions are linked to Bitcoin addresses, offering a higher degree of privacy. It’s important to note that Bitcoin is not completely anonymous; it’s pseudonymous, meaning transactions are public but not directly linked to your personal identity unless you choose to disclose it.

Bitcoin’s P2P network is a game-changer, especially in regions with limited access to banking services. In many parts of the world, people don’t have access to reliable banking. Bitcoin provides these unbanked individuals with a way to participate in the global economy, offering them a financial lifeline that was previously unavailable.

Think about it: with just an internet connection, anyone can send or receive Bitcoin, regardless of their location or financial status. This inclusivity is one of Bitcoin’s most powerful features, promoting financial equality and empowering individuals globally.

A great example of P2P transactions is the use of Bitcoin for remittances. Many people working abroad send money back to their families in their home countries. Traditional remittance services are expensive and slow, but with Bitcoin, these transfers can be done quickly and at a much lower cost.

The peer-to-peer nature of Bitcoin transactions embodies the essence of financial decentralization and democratization. It puts the power back into the hands of individuals, allowing them to manage their finances without relying on traditional banking systems. This is what makes Bitcoin not just a currency, but a revolutionary tool for global financial inclusion.

So, that’s a wrap on the peer-to-peer network. It’s the foundation that allows Bitcoin to function as a truly decentralized, global currency. Stay tuned as we explore how Bitcoin also serves as a store of value in the next chapter.

Store of Value

Bitcoin isn’t just a digital currency for transactions; it’s also considered a store of value. But what does that mean, exactly?

A store of value is an asset that maintains its value over time, rather than depreciating. Traditionally, gold has been a prime example of a store of value. However, Bitcoin offers some unique advantages that make it a compelling alternative.

First, let’s talk about scarcity. There will only ever be 21 million Bitcoins. This fixed supply is embedded in Bitcoin’s code and is mathematically ensured. Unlike fiat currencies, which can be printed in unlimited quantities by central banks, Bitcoin’s scarcity makes it immune to inflation. As more people adopt Bitcoin, its limited supply can drive up demand and, consequently, its value.

Another important factor is Bitcoin’s predictability. The rate at which new Bitcoins are introduced into circulation decreases over time in a process known as the halving. Approximately every four years, the reward for mining new blocks is halved, reducing the rate of new Bitcoin creation. This controlled supply mechanism contrasts sharply with traditional currencies, where central banks can increase money supply at will, often leading to inflation.

Bitcoin’s durability and portability also contribute to its value. Unlike gold, which is heavy and cumbersome to transport, Bitcoin is digital. You can store it on a USB drive, in the cloud, or even memorize your private key. This makes it incredibly easy to transport across borders without the risk of physical theft or loss. Additionally, Bitcoin transactions can be conducted quickly and securely from anywhere in the world, 24/7, without the need for intermediaries.

Now, let’s address the common misconception that Bitcoin has no intrinsic value. Critics often argue that Bitcoin is just a digital string of numbers. However, Bitcoin derives its value from its utility and the trust in its decentralized network. Its use case as a medium of exchange, coupled with its deflationary nature, gives it value. Furthermore, the energy and resources invested in mining Bitcoin also contribute to its perceived value.

#Bitcoin is a store of wealth and it is the best inflation hedge the world has ever seen. Every other asset in the world PALES in comparison to Bitcoins ability to keep up with inflation.

— Toby Cunningham (@sircryptotips) December 5, 2023

No wonder most governments hate it.

Bitcoin’s transparency is another critical aspect of its value proposition. Every transaction is recorded on the blockchain, a public ledger that anyone can audit. This transparency ensures that the supply and distribution of Bitcoin are visible and verifiable by anyone, reducing the risk of fraud and manipulation.

In many ways, Bitcoin can be seen as digital gold. Like gold, it’s scarce, durable, and divisible. However, Bitcoin surpasses gold in terms of portability and verifiability. Its digital nature means it can be divided into tiny fractions, making it accessible for transactions of any size.

People across the globe are recognizing Bitcoin’s potential as a hedge against economic instability and inflation. In countries experiencing hyperinflation or political turmoil, Bitcoin offers a stable store of value that is not subject to government control or interference. This ability to provide financial sovereignty is one of Bitcoin’s most powerful attributes.

So, there you have it—Bitcoin as a store of value. Its scarcity, predictability, durability, portability, and transparency all contribute to its growing acceptance as a valuable asset. Stay tuned as we delve deeper into the technology that makes all of this possible in the next chapter on blockchain technology.

Blockchain Technology

To truly grasp the revolutionary nature of Bitcoin, we need to dive into the technology that underpins it: the blockchain. Blockchain technology is what makes Bitcoin secure, transparent, and decentralized. It’s the backbone of Bitcoin’s entire system, and understanding it is key to appreciating the full potential of cryptocurrencies.

So, what is a blockchain? At its core, a blockchain is a public ledger that records all Bitcoin transactions. This ledger is decentralized, meaning it’s not stored in a single location but distributed across a network of computers, known as nodes. Each node has a copy of the blockchain, which is continuously updated and synchronized.

Here’s how the blockchain works:

- Transactions: When someone initiates a Bitcoin transaction, it’s broadcasted to the network of nodes. This transaction contains details such as the sender’s and receiver’s Bitcoin addresses and the amount being transferred.

- Verification: Nodes validate the transaction using cryptographic algorithms to ensure it’s legitimate. This process checks that the sender has enough Bitcoin to complete the transaction and that the transaction adheres to the network’s rules.

- Block Formation: Validated transactions are grouped together into a block. Each block contains a list of recent transactions, a timestamp, and a reference to the previous block, creating a chain of blocks—hence the name, blockchain.

- Proof of Work: Before a block is added to the blockchain, it must be verified through a process called mining. Miners solve complex mathematical problems, which requires significant computational power. This process, known as proof of work, ensures that adding a new block to the blockchain is difficult and resource-intensive, protecting the network from attacks.

- Block Addition: Once a miner successfully solves the problem, the new block is added to the blockchain and propagated to all nodes in the network. The transactions within the block are now considered confirmed.

- Immutability: One of the key features of the blockchain is its immutability. Once a block is added, it cannot be altered or deleted without changing all subsequent blocks, which would require immense computational power. This makes the blockchain highly secure and tamper-proof.

The blockchain’s design offers several significant advantages:

- Transparency: Every transaction on the blockchain is publicly visible and can be audited by anyone. This transparency ensures that all activity is open to scrutiny, reducing the potential for fraud.

- Security: The decentralized nature of the blockchain means there is no single point of failure. It is extremely difficult for attackers to compromise the network because they would need to control the majority of the nodes, which is practically impossible given the scale of the network.

- Decentralization: By eliminating the need for a central authority, the blockchain empowers individuals to transact directly with each other. This decentralization is fundamental to Bitcoin’s philosophy of financial freedom.

- Efficiency: Blockchain technology can streamline processes and reduce the need for intermediaries. This can lead to faster and cheaper transactions compared to traditional financial systems.

Blockchain technology is not limited to Bitcoin. Its principles are being applied to various fields, from supply chain management to healthcare, showing its versatility and potential to revolutionize many industries. Projects like Ethereum have expanded on the concept by introducing smart contracts, self-executing contracts with the terms of the agreement directly written into code.

In summary, blockchain technology is the foundation of Bitcoin’s success. It ensures security, transparency, and decentralization, making Bitcoin a reliable and revolutionary digital currency. Understanding blockchain is crucial to appreciating the innovations brought by cryptocurrencies and their potential to reshape the future of various industries. Stay tuned as we journey back to Bitcoin’s early days in the next chapter.

Bitcoin's Early Days

Bitcoin’s journey from an idea to a revolutionary digital currency is nothing short of fascinating. Let’s take a step back and explore its early days, which were marked by experimentation, skepticism, and gradual acceptance.

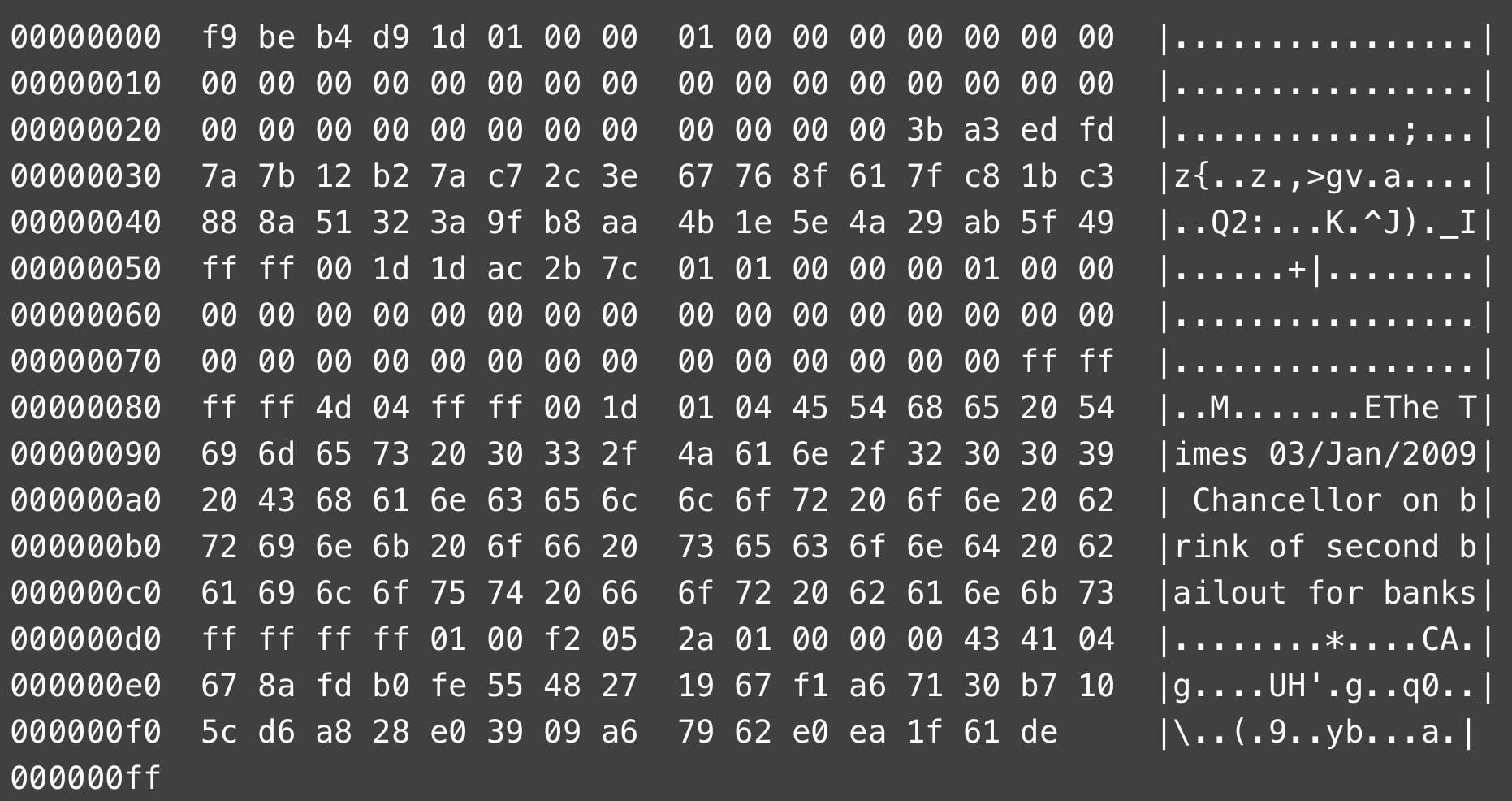

Bitcoin officially came into existence on January 3, 2009, when Satoshi Nakamoto mined the first block, known as the Genesis Block. This block contained a hidden message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks” a reference to the financial instability that inspired Bitcoin’s creation.

In these early days, Bitcoin was mostly known within a small community of cryptographers and computer scientists. Satoshi Nakamoto shared the Bitcoin white paper with the Cryptography Mailing List, sparking discussions and critiques. Many were skeptical, but a few visionary individuals saw the potential.

One of the earliest adopters was Hal Finney, whom we mentioned earlier, a renowned cryptographer who received the first Bitcoin transaction from Satoshi Nakamoto. Finney was instrumental in testing and improving the Bitcoin software, and his involvement gave the project credibility.

In 2010, Bitcoin began to gain more traction. The first Bitcoin exchange, BitcoinMarket.com, was established, allowing people to trade Bitcoin for fiat currencies. This development was crucial in establishing Bitcoin’s value and usability.

April 2010 saw the first Bitcoin auction, where 10,000 Bitcoins were sold for $20. This event demonstrated Bitcoin’s potential to be exchanged for real-world value. But it was the famous Bitcoin Pizza Day on May 22, 2010, that truly marked a turning point. Laszlo Hanyecz bought two pizzas for 10,000 Bitcoins, proving that Bitcoin could be used for everyday transactions.

As Bitcoin started gaining popularity, more exchanges and services began to emerge. One notable event was the launch of Mt. Gox in July 2010, which quickly became the largest Bitcoin exchange. Despite its eventual collapse, Mt. Gox played a significant role in Bitcoin’s early growth.

Bitcoin’s early days were also marked by its use on the Silk Road, an online marketplace that operated on the dark web. Silk Road used Bitcoin for transactions, highlighting its potential for privacy and censorship resistance. While controversial, this use case demonstrated Bitcoin’s ability to function as an independent currency outside traditional financial systems.

Throughout these formative years, Bitcoin’s community continued to grow. Developers, miners, and enthusiasts from around the world contributed to its development, testing its limits and pushing the boundaries of what digital currency could achieve.

Despite facing numerous challenges, from skepticism to technical hurdles, Bitcoin persevered. Its open-source nature allowed anyone to contribute, leading to continuous improvements and innovations. This collaborative effort was essential in establishing Bitcoin as a robust and reliable system.

By 2011, Bitcoin’s value had started to rise, and it was gaining recognition beyond its initial niche community. Articles in mainstream media began to appear, introducing a broader audience to the concept of cryptocurrency.

Bitcoin’s early days were characterized by a blend of idealism, innovation, and practical experimentation. It was a time when a revolutionary idea was tested in the real world, laying the foundation for the widespread adoption and success that Bitcoin enjoys today.

Stay tuned as we continue to explore significant milestones in Bitcoin’s history, including its first auction and the iconic Bitcoin Pizza Day, in the next chapter.

First Bitcoin Auction and Bitcoin Pizza Day

Bitcoin's early milestones were crucial in demonstrating its value and usability. Two pivotal events that stand out are the first Bitcoin auction and Bitcoin Pizza Day.

In April 2010, the first Bitcoin auction took place on BitcoinMarket.com, the first online exchange for trading Bitcoin. During this auction, 10,000 Bitcoins were sold for $20, establishing an initial market value for Bitcoin. This auction helped increase awareness, liquidity, and trust in Bitcoin as a tradable asset.

A month later, on May 22, 2010, Bitcoin Pizza Day marked another significant moment. Laszlo Hanyecz made the first real-world purchase with Bitcoin, buying two pizzas for 10,000 Bitcoins. This event proved that Bitcoin could be used for everyday transactions, further validating its utility and value.

Bitcoin Pizza Day 🍕

These two events were instrumental in Bitcoin's journey from a niche technology to a widely recognized digital currency. They demonstrated Bitcoin's potential as both a store of value and a medium of exchange, setting the stage for its future growth and adoption.

Stay tuned as we explore more significant milestones in Bitcoin’s history, including its use on the Silk Road and its evolving perception in the mainstream.

Silk Road

As Bitcoin continued to gain traction, its potential for privacy and censorship resistance became increasingly apparent. One of the most notable early use cases highlighting these features was its adoption on the Silk Road, an online marketplace that operated on the dark web.

The Silk Road was launched in February 2011 by Ross Ulbricht, known under the pseudonym "Dread Pirate Roberts." The platform allowed users to buy and sell goods and services anonymously, using Bitcoin as the primary means of transaction. This use case showcased several of Bitcoin’s key attributes:

- Anonymity: While Bitcoin transactions are not completely anonymous, they are pseudonymous. Users on the Silk Road could transact without revealing their identities, enhancing privacy.

- Censorship Resistance: The decentralized nature of Bitcoin meant that no central authority could control or shut down the transactions. This was particularly important for the Silk Road, which operated outside the bounds of legal marketplaces.

- Global Accessibility: Bitcoin’s borderless nature allowed people from all over the world to participate in the Silk Road marketplace, regardless of their local financial systems.

The Silk Road quickly became notorious for facilitating the sale of illicit goods, including drugs. This association with illegal activities garnered significant media attention and brought Bitcoin into the public eye, albeit in a controversial light. Despite the negative connotations, this period was crucial in demonstrating Bitcoin's functionality as a medium of exchange.

In October 2013, the FBI shut down the Silk Road and arrested Ross Ulbricht. This event highlighted the risks associated with using Bitcoin for illegal activities. However, it also underscored Bitcoin's resilience; despite the shutdown, Bitcoin continued to thrive and evolve.

The arrest and conviction of Ross Ulbricht in 2015 drew significant attention to Bitcoin. While the Silk Road's association with illegal activities painted Bitcoin in a negative light initially, it also showcased Bitcoin's potential for privacy, security, and global transactions.

The Silk Road era had a lasting impact on Bitcoin's perception. While it initially painted Bitcoin as a currency for illicit activities, it also demonstrated its potential for privacy, security, and global transactions. These features attracted a broader audience who saw beyond the negative press and recognized Bitcoin's revolutionary potential.

Bitcoin's use on the Silk Road was a double-edged sword—it showcased the cryptocurrency's strengths while also bringing scrutiny and regulation. Nevertheless, it was a significant chapter in Bitcoin’s history that helped shape its future development and acceptance.

Next, we will delve into Bitcoin’s growing perception in the mainstream, from being labeled as a tool for criminals to gaining recognition as digital gold and a valuable asset.

Censorship Resistance

Bitcoin’s journey is marked by its ability to withstand scrutiny and operate independently of centralized control. One of the most compelling aspects of Bitcoin is its censorship resistance, a feature that has profound implications for financial freedom and autonomy.

Censorship resistance means that no central authority can block or reverse Bitcoin transactions. This feature is inherent in Bitcoin’s decentralized design. Unlike traditional financial systems, where banks or governments can freeze accounts or block transactions, Bitcoin operates on a peer-to-peer network with no single point of control.

Here’s why censorship resistance is so important:

- Financial Sovereignty: Bitcoin gives individuals full control over their funds. This is particularly vital in regions with unstable governments or oppressive regimes. Citizens can use Bitcoin to protect their assets from seizure or devaluation.

- Unrestricted Transactions: With Bitcoin, you can send money to anyone, anywhere, without needing permission from a bank or government. This is a game-changer for international transactions, remittances, and donations to causes that might be restricted by traditional financial systems.

- Protection Against Censorship: Bitcoin’s decentralized nature makes it resistant to censorship. Even if a government or organization attempts to suppress Bitcoin, the network’s global distribution and the cryptographic security ensure its continued operation.

A notable example of Bitcoin’s censorship resistance in action is the Cyprus banking crisis of 2013. During this crisis, the government imposed strict capital controls, freezing bank accounts and limiting withdrawals. Many Cypriots turned to Bitcoin as a safe haven, highlighting Bitcoin's role as a financial refuge in times of crisis.

Another instance is Wikileaks, which began accepting Bitcoin donations after traditional payment processors like Visa, MasterCard, and PayPal cut off services due to political pressure. Bitcoin’s censorship resistance allowed Wikileaks to receive funding despite the blockade, demonstrating its power to facilitate free financial transactions.

The resilience of Bitcoin’s network is a testament to its robust design. Even in the face of regulatory challenges and attempts to control it, Bitcoin continues to thrive. This resilience is rooted in its decentralized architecture, which spreads the power across a global network of nodes, making it nearly impossible to shut down.

Bitcoin’s censorship resistance is not just about avoiding government interference; it’s about empowering individuals with the freedom to manage their finances without external control. This principle is fundamental to Bitcoin’s ethos and one of the main reasons it has garnered such a dedicated following.

As Bitcoin continues to evolve, its censorship-resistant properties will likely become even more critical. In an increasingly digital world, where financial transactions are often subject to scrutiny and control, Bitcoin offers an alternative that prioritizes freedom and autonomy.

In the next chapter, we will explore Bitcoin's growing perception in the mainstream, from its early days of skepticism to being recognized as digital gold and a valuable asset.

Modern Perception of Bitcoin

Bitcoin’s journey from a niche technology to a mainstream financial asset is a fascinating evolution. Its perception has dramatically shifted over the years, moving from skepticism and controversy to acceptance and recognition as a valuable digital asset.

In the early days, Bitcoin was often associated with criminal activity due to its use on platforms like Silk Road. This association led to widespread skepticism and negative media coverage. However, as Bitcoin continued to prove its resilience and utility, perceptions began to change.

One significant shift in perception came as more people began to understand Bitcoin’s underlying technology and its potential. Early adopters and tech enthusiasts saw Bitcoin not just as a currency, but as a revolutionary technology that could transform financial systems. This understanding laid the groundwork for Bitcoin’s broader acceptance.

Bitcoin’s narrative evolved in several key stages:

- Libertarian Dream: Initially, Bitcoin was embraced by libertarians and those disillusioned with traditional financial systems. They saw Bitcoin as a tool for achieving financial sovereignty and decentralization.

- Digital Gold: As Bitcoin’s scarcity and deflationary properties became more widely recognized, it earned the moniker of “digital gold.” Investors began to see Bitcoin as a store of value, similar to gold, that could hedge against inflation and economic instability.

- Mainstream Investment: The entry of institutional investors marked a significant turning point. Companies like MicroStrategy, Tesla, and investment firms like Grayscale began to invest heavily in Bitcoin, lending it credibility and attracting more mainstream attention.

- Regulatory Recognition: Governments and financial regulators started to take Bitcoin seriously, discussing frameworks for regulation rather than outright bans. Countries like El Salvador even adopted Bitcoin as legal tender, further legitimizing its use.

The involvement of major financial institutions and acceptance by regulatory bodies have significantly bolstered Bitcoin’s legitimacy. For instance, the approval of Bitcoin futures by the U.S. Securities and Exchange Commission (SEC) marked a major milestone, allowing traditional investors to gain exposure to Bitcoin through regulated financial products.

Bitcoin's growing acceptance is also reflected in the proliferation of Bitcoin ATMs and the integration of Bitcoin payment options by major companies. Services like PayPal now allow users to buy, hold, and use Bitcoin for transactions, making it more accessible to the average consumer.

Despite its growing acceptance, Bitcoin still faces challenges, particularly in terms of environmental concerns and regulatory scrutiny. The energy-intensive nature of Bitcoin mining has sparked debates about its sustainability. However, efforts to integrate renewable energy sources and improve mining efficiency are underway to address these concerns.

In summary, Bitcoin’s perception has undergone a remarkable transformation. From being viewed with suspicion and skepticism, it is now recognized as a legitimate financial asset with significant potential. This shift is a testament to Bitcoin’s resilience and the growing understanding of its revolutionary technology.

As we approach the final chapter, we will reflect on Bitcoin’s original purpose and how it continues to influence its trajectory.

Bitcoin's Original Purpose

As we reflect on Bitcoin's journey from its inception to its current status as a mainstream financial asset, it’s crucial to revisit its original purpose. Understanding the foundational goals of Bitcoin helps us appreciate its enduring relevance and potential future impact.

Bitcoin was created in response to the 2008 global financial crisis, a time when trust in traditional financial institutions was severely shaken. Satoshi Nakamoto, the pseudonymous creator of Bitcoin, envisioned a decentralized currency that operated independently of banks and governments. The key goals of Bitcoin can be summarized as follows:

- Decentralization: At its core, Bitcoin was designed to eliminate the need for a central authority. By leveraging a decentralized network of nodes, Bitcoin allows for peer-to-peer transactions without intermediaries, reducing the risks associated with centralized control and failures.

- Financial Sovereignty: Bitcoin empowers individuals by giving them full control over their finances. In traditional banking systems, access to funds can be restricted, accounts can be frozen, and transactions can be censored. Bitcoin offers an alternative where individuals can manage their assets independently.

- Transparency: Bitcoin operates on a transparent public ledger, the blockchain, where all transactions are recorded and can be audited by anyone. This transparency reduces the potential for fraud and corruption, fostering greater trust in the system.

- Security: The cryptographic principles underpinning Bitcoin ensure a high level of security. Transactions are secure, and the decentralized nature of the blockchain makes it highly resistant to attacks.

- Inflation Resistance: Unlike fiat currencies, which can be printed in unlimited quantities by central banks, Bitcoin has a fixed supply of 21 million coins. This scarcity is built into its protocol, making it a hedge against inflation and currency devaluation.

Bitcoin's original purpose was to create a financial system that was more fair, transparent, and secure. Over the years, while the narrative around Bitcoin has evolved, these core principles remain intact and continue to drive its development and adoption.

As Bitcoin gained traction, it started to fulfill roles beyond its initial vision. It became a store of value, often referred to as "digital gold," and a tool for financial inclusion, providing access to financial services in regions where traditional banking is unavailable. Despite the evolving uses and perceptions, Bitcoin’s foundational goals still resonate with its community and new adopters.

Looking forward, Bitcoin’s original purpose will likely continue to guide its trajectory. As the world faces ongoing economic challenges and technological advancements, Bitcoin's principles of decentralization, financial sovereignty, transparency, security, and inflation resistance will remain relevant.

In conclusion, Bitcoin’s journey from its creation to its current status is a testament to its robust design and the visionary goals of its creator. As it continues to evolve, Bitcoin’s original purpose serves as a beacon, guiding its path and ensuring its relevance in the ever-changing financial landscape.

Thank you for joining us on this exploration of Bitcoin’s history, purpose, and impact. Stay informed, stay curious, and continue to explore the revolutionary world of cryptocurrencies.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk; you should always do your own research before making any investment decisions.